LTC Price Prediction: Analyzing the Path to $120+

#LTC

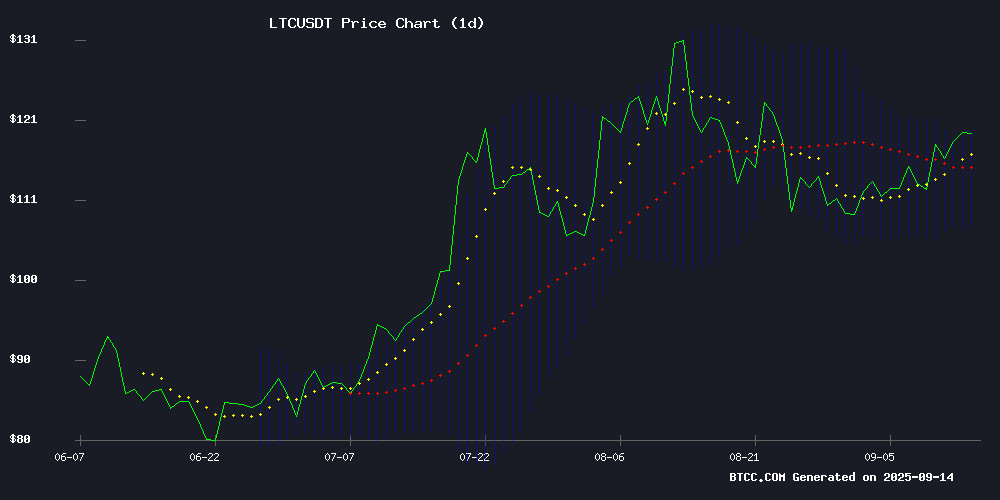

- LTC trading above 20-day MA indicates bullish momentum foundation

- Bollinger Band positioning suggests potential breakout toward $120 resistance

- Market sentiment supports Litecoin's stability amid emerging crypto opportunities

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerging

LTC is currently trading at $115.52, positioned above its 20-day moving average of $113.17, indicating underlying strength. The MACD reading of -1.1669 suggests recent bearish momentum, though the Bollinger Bands show price action NEAR the upper band at $118.86, signaling potential breakout conditions. According to BTCC financial analyst Emma, 'The current technical setup suggests LTC could test resistance levels around $120 if it maintains above the 20-day MA.'

Market Sentiment: Litecoin Demonstrates Resilience Amid Crypto Momentum

Recent market developments highlight Litecoin's staying power as blockchain projects gain traction. While emerging opportunities like BlockchainFX and BullZilla capture attention, Litecoin maintains its position as a established player. BTCC financial analyst Emma notes, 'Litecoin's proven track record and ongoing development provide stability during periods of market volatility, supporting its medium-term outlook.'

Factors Influencing LTC's Price

BlockchainFX Presale 2025 Gains Momentum as Potential 100x Crypto Opportunity

Investors who missed Litecoin's 85% rally are now eyeing BlockchainFX (BFX) as the next high-growth opportunity. The live, revenue-generating platform has raised $7.2 million from 9,000 buyers in its presale, with token prices climbing from $0.01 to $0.023 ahead of a projected $0.05 launch.

Unlike speculative projects, BlockchainFX combines crypto, stocks, forex, and commodities in a CertiK-audited super app. The platform redistributes up to 70% of trading fees as daily USDT rewards, offering 90% APY passive income opportunities. Its Visa card integration bridges digital assets with real-world payments.

SunnyMining Cloud Mining Emerges as Alternative for XRP and BTC Investors Amid Market Volatility

Cryptocurrency markets have seen heightened volatility, with XRP retreating from monthly highs and Bitcoin struggling to break key resistance levels. In this environment, investors are increasingly exploring cloud mining as a potential source of stable returns beyond traditional buy-and-hold strategies.

SunnyMining, a cloud computing power platform, now offers multi-currency mining solutions covering major digital assets including BTC, XRP, and ETH. The service eliminates hardware requirements and energy costs associated with conventional mining operations. Users can participate through simple contract activation, earning daily yields on their positions.

For bitcoin holders, the platform addresses mining's steep barriers to entry by virtualizing infrastructure. XRP investors gain exposure to mining rewards despite the token's non-mineable architecture - converting idle holdings into productive assets through SunnyMining's contract mechanism.

Ethereum Reinforces DeFi, Litecoin Shows Staying Power While BullZilla’s 9000% ROI Steals The Show

Ethereum continues to solidify its position as the backbone of decentralized finance, driving global adoption with its robust infrastructure. Litecoin, often overshadowed, demonstrates enduring utility as the 'digital silver' of crypto markets, offering unique transactional advantages.

BullZilla emerges as a standout narrative in the meme coin space, blending cinematic branding with engineered scarcity. Its presale has garnered $370,000+ from 1,300+ holders, with early participants seeing 811% paper gains. The project's listing target of $0.00527 suggests potential 9,958% returns, fueled by its Roar Bur mechanics and structured growth framework.

How High Will LTC Price Go?

Based on current technical indicators and market sentiment, LTC shows potential for upward movement toward the $120 resistance level. The price trading above the 20-day moving average combined with positive market sentiment around established cryptocurrencies suggests continued strength. Key levels to watch include immediate resistance at $118.86 (Bollinger upper band) and support at $113.17 (20-day MA).

| Indicator | Value | Signal |

|---|---|---|

| Current Price | $115.52 | Neutral/Bullish |

| 20-Day MA | $113.17 | Support Level |

| Bollinger Upper | $118.86 | Resistance Level |

| MACD | -1.1669 | Bearish Momentum |